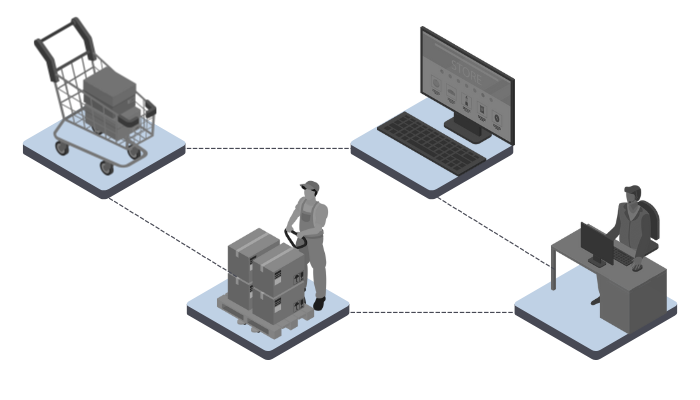

Omni-channel payments bring together all of a merchant’s transactions – across all of their sales channels – on a single platform. Whether customers buy online, in a retail store, at tradeshows, over the phone, or even by mail, omni-channel payment processing lets merchants consolidate the corresponding operations. Card-present and card-not-present transactions all flow through the same solution, which provides a much simpler merchant experience – not just in terms of order entry and financial operations, but also in implementation and support.

Easier Implementation

Omni-channel payments let merchants implement once and use everywhere. Of course, merchants may need to modify their existing solutions when they add new channels (for instance, they’ll need to buy and configure credit card terminals if they open a brick-and-mortar store to complement their existing online sales.) However, adding new card acceptance methods on a platform that’s built for omni-channel payments is much simpler than finding, vetting, and implementing entirely separate technologies for each sales channel. The merchant’s IT team will already be familiar with their existing solution provider’s documentation, APIs, and testing utilities, and end users will already have an established relationship with their support team. Adding new functionality is far less complicated (and far less costly!) than starting each new project from scratch.

Streamlined Support

Payment acceptance seems like it should be simple, but there are countless complexities behind the scenes. What if the terminal loses its connection to the server? What if a settlement fails? What happens when an API call doesn’t return the expected result? What if you need to run a zero-dollar authorization or adjust the transaction amount after the authorization? Working with one support team who is already familiar with your business, its unique processes, and the rest of your payment infrastructure (including your merchant services provider or your ERP) will get you faster, more relevant recommendations.

Consolidated Reporting

As merchants look to increase efficiency in every department, streamlining the reconciliation and reporting process for their accounting and finance teams can lead to major improvements. Users don’t have to chase down separate records from their e-commerce platform, their point-of-sale system, and their back-office order entry system. All the data is available in one place.

More Accurate Consumer Insights

To the same end, omni-channel payment processing allows more accurate tracking for analyzing business trends. Merchants can more easily see how sales are tracking at each of their locations or business units; where chargebacks are originating; and where they’re paying extra processing fees that are cutting into their revenue.

A Smoother Customer Experience

Omni-channel payments aren’t just beneficial for merchants; they deliver a better customer experience as well.

Omni-channel tokenization, for instance, lets customers save their credit and debit cards to a digital wallet, which can then be re-used next time they make a purchase. They don’t have to provide their card number, zip code, and security code – even if they make their next purchase through a different channel than their original transaction. Seems straightforward, but when a merchant uses one solution for e-commerce payments, one solution for retail payments, and one solution for phone orders, their tokens can’t be shared across platforms and customers don’t benefit to the same extent.

Related Content: Evaluating Omni-Channel Payments Solutions

Discover Curbstone’s Secure Omnichannel Payments Platform

At Curbstone, we’ve developed a fast, secure omnichannel payments platform that supports all the ways you do business. Check out all the ways you can consolidate your retail, e-commerce, and MOTO transactions, or contact us to learn more.