Manage all of your transactions – from everywhere you do business – on a single, convenient platform. Settle your retail, online (e-commerce), mail order, and phone order transactions from the same engine.

Automated Daily Batch Settlement

Get paid as quickly as possible - with less manual work from your team.

Automatically Assemble and Send your Credit Card Settlements

You don't get paid until you settle your authorizations. Your customer’s funds are held when an authorization request is approved, but the money is only transferred to your bank account after you have submitted the day’s charges for settlement. That means constant work for your receivables team – and a high potential for disruptions in your cash flow.

With Curbstone, the entire process is easier. Our automated approach eliminates delays and reduces manual work, automatically batching and transmitting your ready-to-go transactions.

A Faster, Easier Merchant Settlement Process

Your existing job scheduler sends your settlement batches to your acquirer each day, putting an end to the time-consuming process of flagging each individual transaction to be included in the daily settlement batch. That’s more time for you to focus on what really matters: growing your business.

Settle all of your transactions from a single platform

Modify transactions prior to settling

If you need to change the final amount of a charge or change the status of a pending transaction, Curbstone makes it easy to do so. You can also update invoice numbers, tax amounts, Level II or Level III Corporate Purchasing Card data, or other user-defined fields before you settle.

Reduce settlement downgrade fees

Every day you delay submitting your transactions, the higher your processing fee. If you don’t settle within the industry’s specified time frames, you pay a compounding downgrade fee – but Curbstone makes timely settlement simple.

Meet your batch settlement deadlines without extra work from your accounting team. For Level II and Level III Corporate Purchasing Cards, pass complete line-item detail reports as part of each settlement – with no extra effort – to qualify for lower rates.

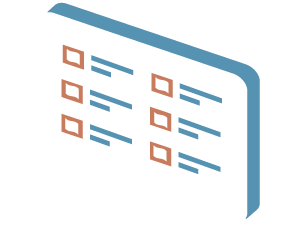

Complete Visibility Into Your Settlement Batches

From a streamlined merchant interface, Curbstone’s Settlement Manager lets you view batches for every location, department, or profit center. Drill down as needed from a daily to an individual transaction level; configurable reporting lets you easily identify transactions in any status.

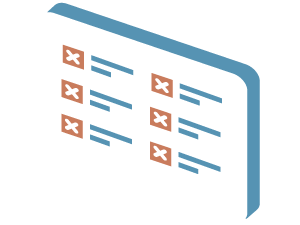

Approved, Not Flagged to Settle

Approved, Flagged to Settle

Approved, Settlement Granted

Discover A Better Approach to Credit Card Batch Settlement

Our technologies have helped hundreds of merchants streamline their batch settlement process.

When you're ready for a faster, more efficient approach to credit card processing, we're here to help.