Many manufacturers are surprised to learn that their industry is one of the top targets for security threats.

Retail? With the amount of credit card data being passed back and forth, it makes logical sense.

Banking? Again, it’s easy to see the motivation when you think about financial fraud.

Government agencies? That can also make sense, especially in terms of political espionage.

But manufacturing? An industry that’s often seen as “too slow” to adopt new technology? That may come as a bit of a surprise.

However, in the 2023 Verizon Data Breach Investigation Report, manufacturing was (once again) identified as one of the top five most-targeted industries, by number of incidents. So: what should manufacturers know about the current cybersecurity landscape?

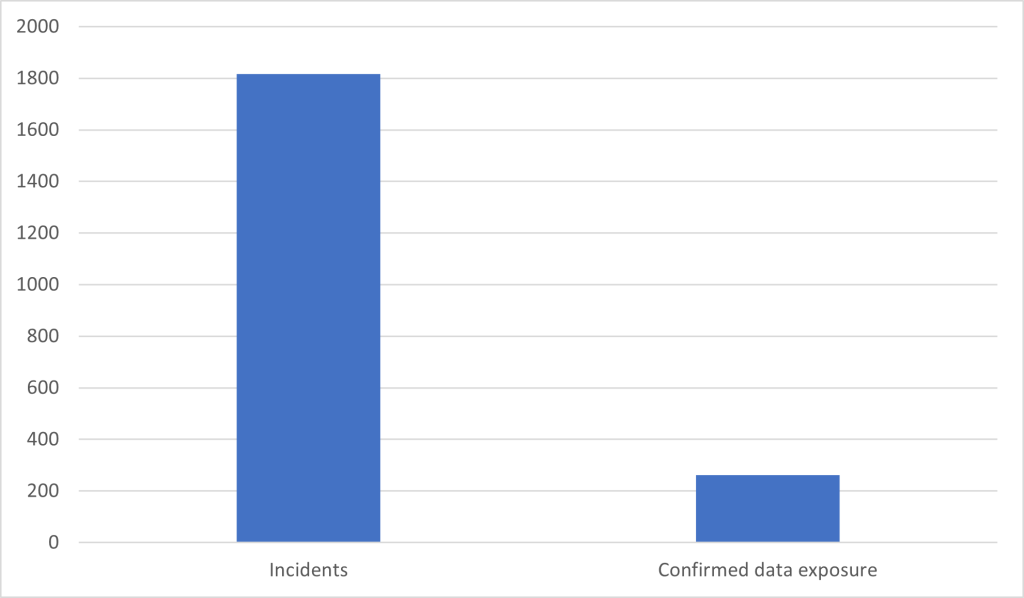

Despite the high number of incidents, less than 15 percent of incidents resulted in confirmed data exposure.

Consider this in contrast to the retail industry, where nearly half of incidents resulted in confirmed data exposure. This indicates that the typical manufacturer’s attack surface may be less vulnerable to threats – or that their controls are more effective against current attacks.

90 percent of threat actors were external.

It was far less likely for a breach to involve someone inside the company.

Hacking and malware were the most common attack methods.

DDOS attacks continued to rise in popularity in comparison to previous years.

Build a Stronger Payment Card Security Program

At Curbstone, we’ve been in the payments industry for more than 20 years; we’ve seen countless cybersecurity threats come and go. However, our focus on secure credit card processing has remained the same. We’ve helped manufacturers and distributors of all sizes process credit card payments without storing or transmitting the data on their own systems, which provides a higher level of security from cyber threats. At the same time, this helps take part – if not all – of their infrastructure out of scope for PCI audits, which considerably reduces the burden of reporting and compliance.

Ready to start building a stronger payment card security program? Check out all the ways our technologies can help you securely process payments online, in person, and even over the phone, or start a conversation with a member of our team.