As a merchant, when it comes to credit card fees: who are you paying and where, exactly, is your money going? With credit card processors using various pricing models – some more complex than others – it can be difficult to understand what each individual charge represents. However, you need to know how much you are paying in fees each time your customer swipes their card for a transaction – otherwise, you risk losing hard-earned revenue to unnecessary fees.

What is Flat Rate Pricing?

Flat rate pricing is – as the name implies – a pricing model where credit card processors charge one single, flat fee for every transaction. This is a straightforward option for merchants, but the lack of surprises can come at the expense of savings. Processors typically charge a higher rate per transaction; you as the merchant receive no potential discounts that you might otherwise qualify for.

With flat rate pricing, you may also lose visibility into what you’re paying and why. Individual fees are rarely itemized, so your Finance team may not be able to take a deep dive into the various expenses associated with your credit card payments.

What is Interchange Plus Pricing?

Interchange plus pricing is a pricing model that starts with the base interchange fees charged by Visa and Mastercard, plus a small transaction fee to cover the processor’s service.

The interchange rates are dependent on several factors, including the industry in which the purchase is being made and the type of card being used. For example, a purchase made in a supermarket with the Visa Signature Preferred card would have an interchange rate of 2.10% + $0.10, while if that same supermarket purchase was made with a Traditional Rewards card, the rate would be 1.65% + $0.10. (Note that each card brand sets their own interchange rates and these rates may change several times per year – often in April and October.)

On top of these interchange rates, the interchange plus pricing model also includes the processor’s fees for processing your transactions.

Which Pricing Model Offers Lower Credit Card Fees for Merchants?

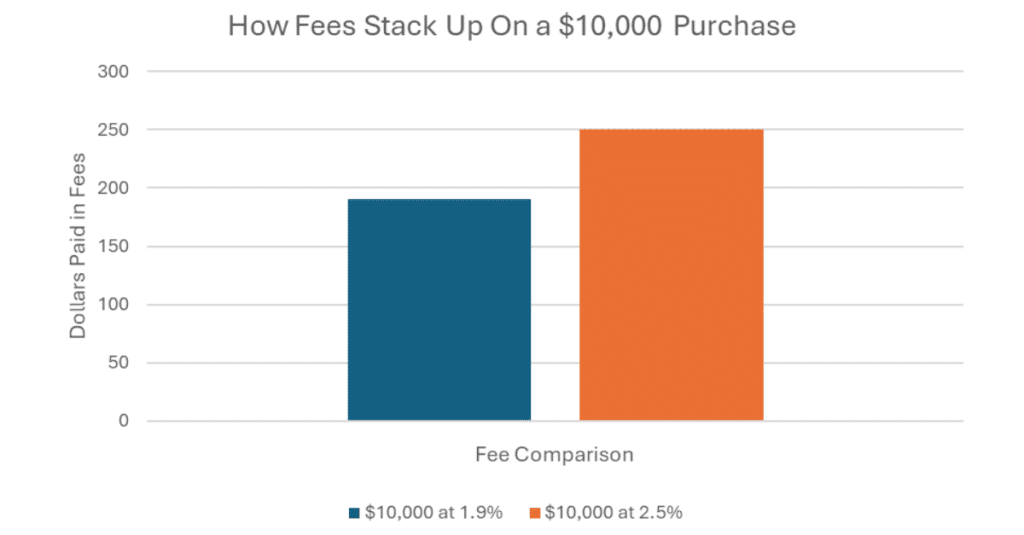

Merchants can generally expect lower credit card processing fees with interchange plus pricing, especially when they are able to optimize their interchange rates. With flat rate pricing, merchants will pay (as an example) 3.5% and $0.20 per transaction, no matter the kind. With interchange plus pricing, however, they may be able to qualify some of their transactions for a lower percentage of the overall cost and/or a lower per-transaction fee. For instance, they can pass additional data through to their acquirer when they settle transactions that were made using a Level 2 or Level 3 Corporate Purchasing Card, helping them qualify for a lower rate.

That’s where it’s particularly important to work with a processor who can help ensure you’re getting the best credit card processing rate. 2.25% and $0.10 vs. 1.9% and $0.10, for example, can make a huge difference on your bottom line when you’re processing millions in credit card transactions each year. It does require a concerted effort to achieve these savings, but interchange plus is – in many cases – the most cost-effective credit card pricing model in the industry.

Save Money with Interchange Plus Pricing and Rate Optimization

At Curbstone, we’ve helped hundreds of merchants achieve the lowest possible credit card fees. We’ll guide you through the steps of setting up your transactions to qualify for the lowest interchange rates, taking the guesswork out of the process.

Interested in seeing how much you could save? Contact us with your questions and let us help you get started!